The global AI in asset management market size is expected to reach USD 13.43 billion by 2027, according to a new report by Grand View Research, Inc., expanding at a CAGR of 37.1% from 2020 to 2027. Artificial intelligence in asset management refers to the automation of IT assets lifecycles with intuitive workflows and making informed decisions about asset vendors and capacity. Asset and wealth management firms are exploring potential artificial intelligence-based solutions to improve their investment decisions and extract insights out of their historical data. The current landscape of artificial intelligence (AI) applications in asset and investment management includes the management of digital assets and physical assets and investment advisory consumer applications. For instance, The Vanguard Group, Inc., a U.S.-based investment firm, offers the PAS (Personal Advisor Services), which runs on automated algorithms and can potentially prompt customers with investments-related advisories with insights from human advisors.

The COVID-19 outbreak has created significant uncertainties and challenges for the WAM industry. However, this crisis may accelerate certain activities related to the speed of digital transformation and automation as some markets have shown high acceptance towards digital or virtual approaches related to client interaction and distribution. Moreover, key players are leveraging AI and machine learning technologies to improve resilience and enhance productivity. For instance, in April 2020, Exabel, a Norway-based FinTech company that provides an AI platform for active asset managers, announced its partnership with 1010data, Inc., a U.S.-based data provider to the consumer goods, retail, and BFSI industries. Under the agreement, both the companies are working on building COVID-19 impact dashboards, which will derive the information from multiple sets of live debit and credit transaction data. This information is anticipated to provide investors real-time insights into how this pandemic impact consumer spending in grocery and general merchandise, retail, and travel industries across U.S. Furthermore, omnichannel and ecosystem strategies are expected to become embedded within the capital markets sector to maintain restricted social distancing and travel in place.

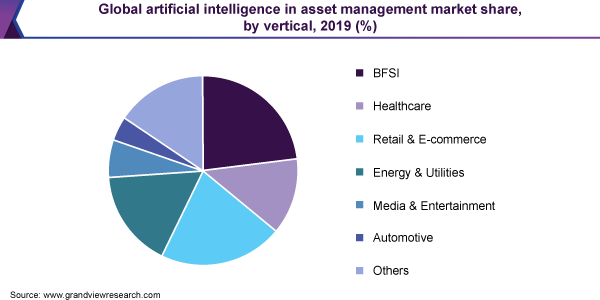

The global artificial intelligence in the asset and wealth management industry has been steadily expanding and witnessing substantial transformations due to the fundamental shift in global finance and technology. The noticeable rapid progress in technology in the last two decades has significantly improved the way industry professionals store and process data. The cost of collection and processing of stock market data across verticals has consequently reduced, which has brought new possibilities for improvement in decision-making mechanisms across industries. Analytics is revolutionizing the problem-solving paradigms of the asset management industry by reforming the functioning of some of the dimensions, including client profiling, product recommendations, customer churn, sentiment analysis, and marketing and strategy.

/image%2F6144638%2F20210212%2Fob_6c6671_ai-in-asset-management-market.png)

View exclusive Global strategic Business report

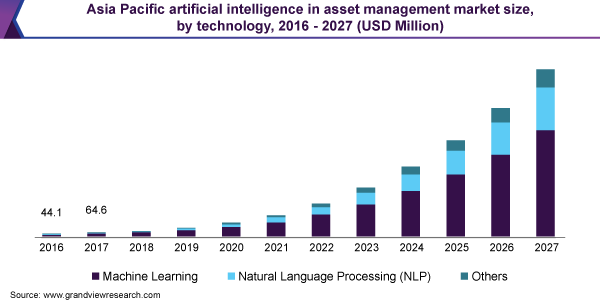

Exponentially increasing data volumes, strict regulations, and low-interest rates are encouraging asset managers to reconsider their traditional business strategies. Moreover, recent technological advancements have paved the way for artificial intelligence in asset management. Connection of knowledge, domain-enriched ML (machine learning), and NLP (natural language processing) techniques are being adopted by several FinTech companies to offer improved financial and investment services. For instance, in September 2019, China Asset Management, a China-based fund management company, collaborated with Microsoft’s researchers to develop an AI model. This AI model analyzes the vast amount of real-time data of financial transactions. This partnership was done under the Microsoft’s Innovation Partnership program, under which AI expertise is shared with companies across various industries to help them derive digital transformation in their portfolio.

Further key findings from the report suggest:

- Asset management organizations are using natural language processing (NLP) and other AI techniques to recommend optimal actions for specific processes by analyzing voice and text communications

- NLP associated with machine learning technology helps in incorporating a wide range of sources into press releases, financial reports, retrieving filings, investment models, and social media activity

- Portfolio construction and optimization is an effective application of AI in asset management as it provides predictive forecasting of long-term price movements

- In asset management, social media analytics is an emerging trend, which is primarily used for research analyst opinion, market sentiment, influencer, and demography analyses.

To understand key trends, Download Free Sample Report

Artificial intelligence is integrated with the asset and wealth management for several purposes, such as improving the operational efficiency, customer experience and interfaces, and investment processes. Essential applications of AI to increase operational efficiency include monitoring, quality checking, and the exception handling of the vast amount of data on financial instruments. Improving data quality is of the utmost importance as it reduces operational risks and helps in client retention. For instance, Presenso, an Israel-based start-up, offers a cloud-hosted software for predictive maintenance of industrial assets. It helps industrial manufacturers to detect abnormalities in their sensor data with the use of machine learning techniques. Furthermore, the platform offered by the company prompts alerts to asset managers in case of any equipment or asset breakdown.

Researchers have made tremendous strides in developing the ultimate human-machine interaction systems in recent years. AI is used to capture audio, text, and imagery data from various vendor/internal databases and public sources by implementing computer vision, NLP, and voice recognition programs. For instance, computer vision and NLP are used for data extraction from issuer filings for valuation models and transcription of analyst conference calls. More extensive programs will further process the information gathered from various sources to generate insights into the investment decision-making process. This often requires advanced AI techniques, such as machine learning and deep learning.

Considering the novel COVID-19 (coronavirus) pandemic, there has been a massive surge in relocations and deployments of devices and equipment, with millions of employees displaced to WFH (Work-From-Home) environments. The ability to procure, deploy, and manage hardware assets has become considerably complicated, with the urgency of bringing millions of remote devices on-line. However, businesses that continue to leverage the use of artificial intelligence are expected to take this pandemic as an opportunity. For instance, AI can help firms in creating actionable insights for connected devices and reducing costs with smart asset management techniques.

Machine learning led the market and accounted for more than 65.0% share of the global revenue in 2019. This is attributed to increasing process automation in manufacturing industries. Machine learning (ML) reflects the natural evolution of technology as machines are capable of sorting through large datasets and extract information by identifying patterns and outliers. ML is being employed in the asset management systems to increase the accuracy and efficiency of operational workflow, improve the customer experience, and enhance the system performance.

Machine learning is used to detect patterns in unstructured and structured data to deliver actionable insights to enable investment-related decision-making ability. For instance, Infosys Limited, a tech giant in IT services, offers a machine learning-based AI platform, called KRTI 4.0 that provides smart decision making on all levels of the organization. KRTI 4.0 is designed as an enterprise-wide decision-making support tool, enabling seamless sharing of learnings from one facility across the whole enterprise and accelerating the analytical knowledge. Moreover, machine learning helps in searching for correlations between world events and their impact on prices of assets, consequently improving the decision-making in asset management.

To obtain all-inclusive information of global market, request a PDF brochure here

On-premises led the market and accounted for 60.1% share of the global revenue in 2019. This is attributed to the security and privacy provided by the on-premises solutions in asset management. Moreover, on-premise solutions use edge analytics that reduces the bandwidth requirement. Integrating these solutions on-premise brings higher speed and more reliability in the results.

The cloud segment is anticipated to witness substantial growth over the forecast period. This growth is attributed to the fact that cloud solutions remove the firewall restrictions that can hamper the users’ access to an on-premise solution. Cloud-based SaaS (software-as-a-service) solution eliminates maintenance and overhead costs. Moreover, cloud object storage services provide the virtually unlimited storage capacity that removes the scalability and storage volume restrictions of locally-placed hardware.