The global smart refrigerators market size is expected to reach USD 624.7 million by 2025, according to a new report by Grand View Research, Inc. It is projected to expand at a CAGR of 13.7% during the forecast period. Rapid advancements in IT infrastructure and wireless communication is anticipated to favor the growth. Multiple benefits such as energy efficiency, optimized cooling operations, facilities of digital display of the product expiry, alerts for timely usage of foods are spurring the acceptance of smart refrigerators across the residential and commercial sectors.

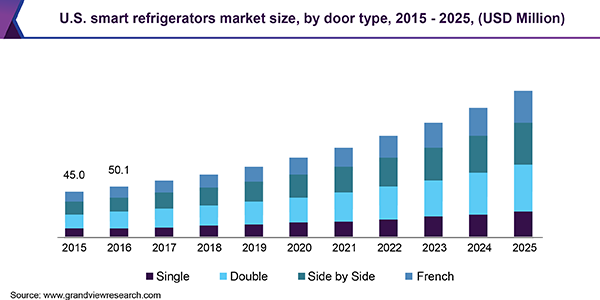

French door category is expected to register the fastest CAGR of 14.0% from 2018 to 2025, thereby accounting for a revenue share of 20.2% by 2025. This product generally has 3 or 4 doors to support the expanding number of nuclear families. Moreover, habit of stocking ample groceries due to busy lifestyles and growing trend of storing preserved food are expected to support the growth of this category in near future. French door smart refrigerators also have a wide application in the food service industry and food retailers wherein they need to maintain large stock of products to serve the customers.

In 2018, Electrolux and a Sweden based startup Karma had introduced smart refrigerators for grocery stores. The product is integrated with Karma’s application and will help reduce food wastage. It is designed to efficiently create storage and pickup points for all the unsold products. This facility will help the retailers keep a track of the expiry dates of left over items and sell them off on time.

View exclusive Global strategic Business report

In 2018, North America led the global smart refrigerators market with a share of 31.2%. Rising purchasing power, awareness about the advantages of the product, and rising standard of living have been driving growth of the regional market.

Further key findings from the report suggest:

- Double door segment was estimated to account for the highest revenue share of about 33.6% in 2018

- French door segment is expected to register the fastest CAGR of 14% during the forecast period

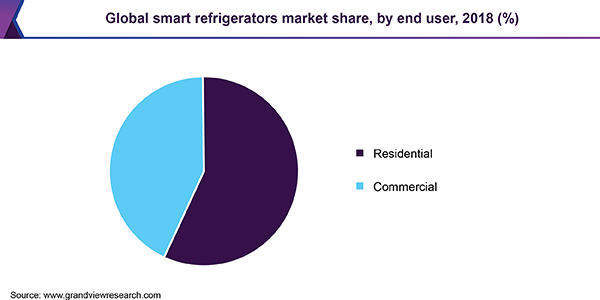

- Commercial end use is expected to have the fastest acceptance, thereby expanding at a CAGR of 14.1% over the next few years

- Offline distribution channel is expected to witness the fastest CAGR of 71.2% by 2025

- Asia Pacific smart refrigerators market is expected to register a CAGR of 15% by 2025, owing to developing economies, improved standards of living, and rising disposable income

To understand key trends, Download Free Sample Report

Asia Pacific is expected to expand at the fastest CAGR of 15% over the next few years. The growing urban population with high purchasing power is expected to favor strong regional demand for smart and connected refrigerators. Moreover, the noticeable rise in adoption of smart appliances is also expected to propel the regional market growth over the forecast period.

Some of the key players operating in the global market include Electrolux AB, Hisense Co. Ltd, LG Electronics, Midea Group, Samsung Electronics Co. Ltd, Siemens AG, GE Appliance, Haier Group Corporation, Whirlpool Corporation, and Panasonic Corporation.

Companies are continuously upgrading and introducing enhanced product features to cater to the changing requirements of the consumers with busy lifestyles. For instance, in 2018, Samsung introduced a new fridge integrated with a 21-inch touch display, cameras, and speakers, to allow the consumers to list down grocery items, read out schedules, view food expiry dates on digital screen, and watch video clips.

Lack of monitoring and timely use of refrigerated foods lead to wastage which is a common problem for the end-users. The United Nations Development Program had stated that in India, around 40% of food is wasted and about 20% of purchased food is discarded. The need for effective food management in residential as well as commercial sectors is expected to result in an increasing acceptance of smart refrigerators. The ability of these smart products to monitor and control the quality and shelf life of the food and generate timely user alerts is expected to drive the market.

Manufacturers are continuously developing and modifying these products to cater to the easy lifestyles of the tech savvy consumers. For instance, in 2018, Samsung had introduced a new refrigerator integrated with cameras, a 21-inch touch display, and speakers, to provide a smart user experience. Apart from normal cooling and retaining freshness of the food items, this product also allows the users to list out shopping items, read out schedules, and also watch video clips. Moreover, the cameras equipped with this fridge displays the expiry dates of food for effective usage.

The primary long term benefit of these products is that they can significantly increase the energy efficiency. Earlier refrigerators used up to 1,278 KW hours per year, whereas the smart refrigerators use less than half of this power while still providing an average capacity of more than 21.9%. This tangible benefit is expected to drive the product demand, especially among the residential sector.

Double door smart refrigerators are featured with compact inbuilt freezer on the top. The segment held the leading market share of 33.6% in 2018, owing to higher affordability and energy efficiency of the product. Owing to rising preference from the residential sector, companies have been introducing smart technology integrated with this category. For instance, LG had introduced an Auto Smart Connect top mount 260 litres frost free refrigerator equipped with multiple functioning capabilities such as auto connect with inverter and smart diagnosis to name a few.

Offline stores are expected to have the highest share and fastest growth in the global market. This distribution channel is projected to register a CAGR of 13.8% in the next few years. Large and complex appliances generally account for less than 10% of e-commerce and online retailers as they demand prior check and scanning of the product attributes and functionalities. This medium is expected to account for a revenue share of about 71.5% by 2025.